WooCommerce PACTACT Tax for Vape & Tobacco Taxes

With the incredible burden that the PACT Act has placed on small businesses, the regulations surrounding the taxes for potentially thousands of jurisdictions, different rates by percentage, per $ amount, and by bottle size, this plugin helps you collect the proper tobacco and vape related taxes.

Features

Vape Tax That Works for You

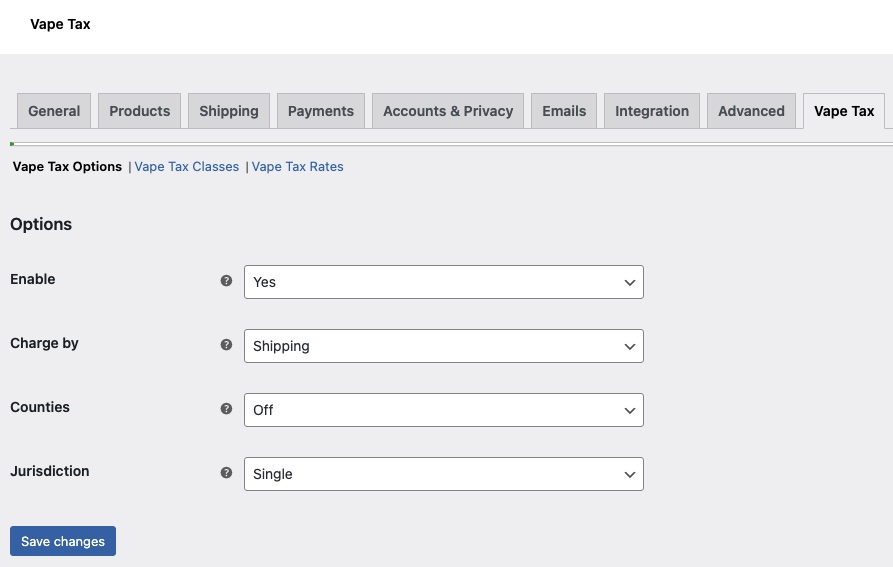

- Tax by shipping or billing address

- Turn on Counties if you need to collect taxes in a county

- If turned on, Counties will show on the checkout

- Tax by a compounded or single jurisdiction

Features

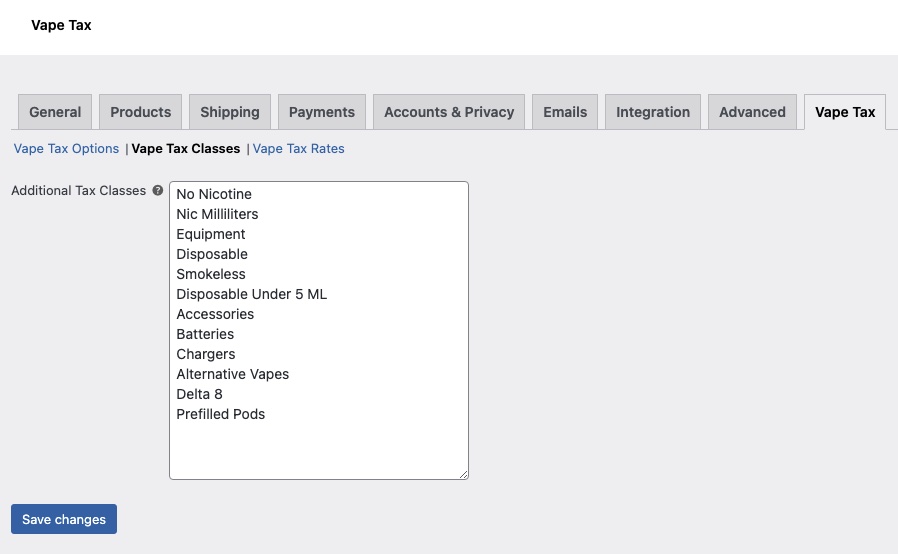

Define All Those Classes (Product Types)

The plugin allows you to set up as many product types (classes) as you need. Most vape sites need about 10, but the options are unlimited!

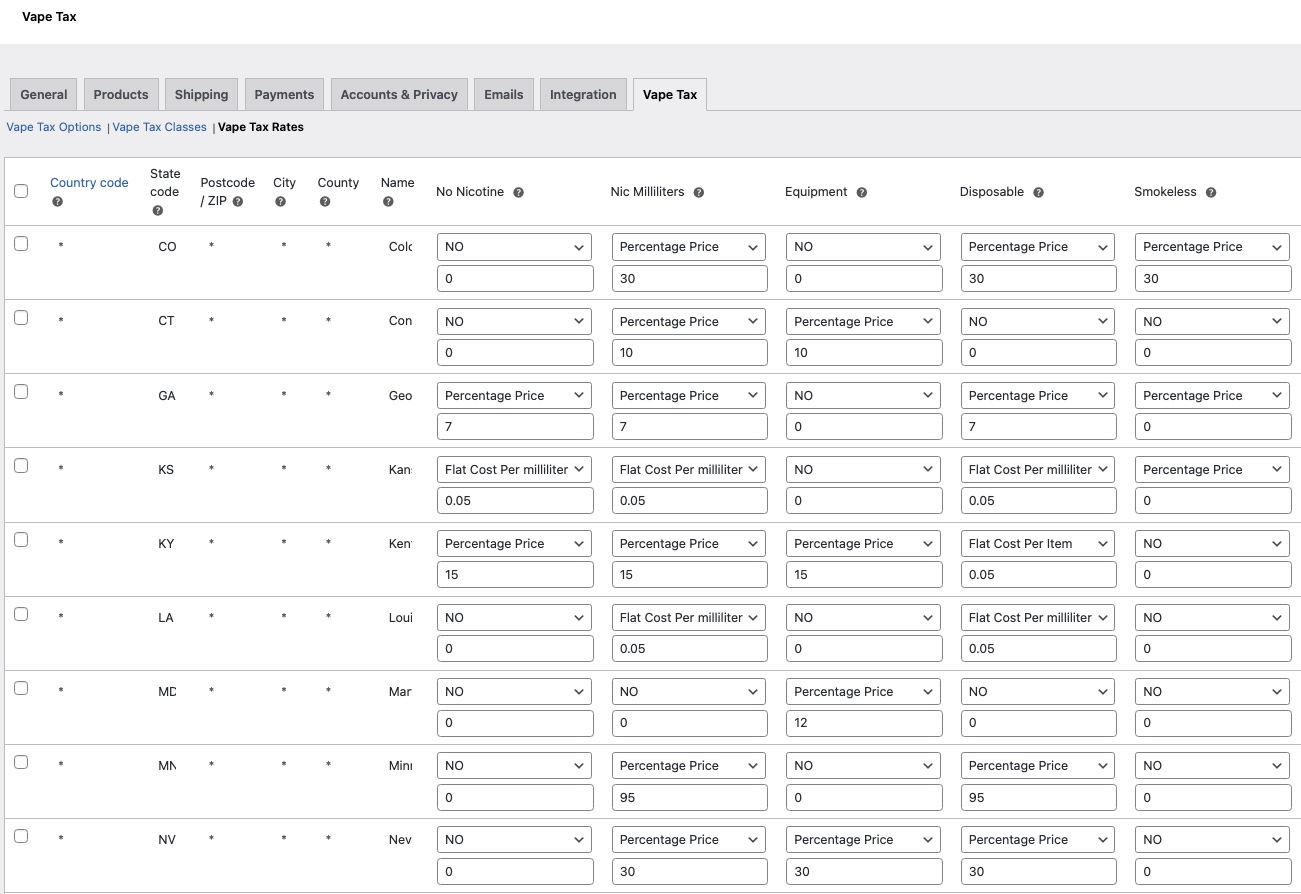

Rates by Jurisdictions

Our plugin allows you to

- Set your taxes by Country, State, Zipcode, City, and County levels

- Set tax names

Set Tax by Type of Product

You can set your taxes according to the type of product.

For example, you tax set a tax rate in Colorado for Vape Juice that has no nicotine, and one for Vape juice that has nicotine.

- Unlimited number of product types

- Unlimited zones

Calculate Custom Tax

Our plugin allows you to calculate taxes in different ways, depending on locale, state, and national tax rules.

Calculate each zone and product type by:

- No tax

- Percentage of Price

- Percentage of Nicotine

- ML of Nicotine

- ML of Juice

- Flat Cost per Order

- Flat Cost per Product